Now that it is official that you need to link your Aadhar and PAN card details, the obvious question is how to do it. This post will explain that. But before that i will like to explain some points.

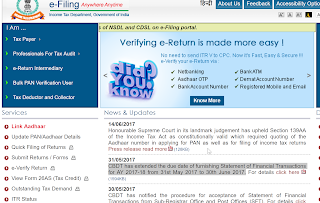

The Honourable Supreme Court in its landmark judgement has upheld Section 139AA of the Income Tax Act as constitutionally valid which required quoting of the Aadhaar number in applying for PAN as well as for filing of income tax returns. The Income Tax India official website shows this message clearly as on 14/06/2017. CBDT has extended the due date of furnishing Statement of Financial Transactions for AY 2017-18 from 31st May 2017 to 30th June 2017. https://incometaxindiaefiling.gov.in/

Method 1: Online Portal To link your Aadhaar with PAN:

* Go to the income tax e-filing website https://incometaxindiaefiling.gov.in/

* Click on the tab ‘Link Aadhaar’ on the left-hand side of the website. (See above screenshot)

* This will automatically lead you to https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

* Fill your PAN and Aadhaar number

* Then enter your name exactly as mentioned in Aadhaar and then submit it.

* Enter captcha and click on 'Link Aadhaar'.

* After verification of details from the Unique Identification Authority of India (UIDAI), the linking will be confirmed.

* You will also get email at your registered email Id.

* In case, your linking was already done earlier, it will tell you that its already linked.

Method 2: SMS Method to Link you Aadhar and PAN card

For this you have to keep ready following information:

1. Your registered phone number with Adhar card

2. Your Aadhaar Number

3. Your PAN number

You need to send an SMS in a required format to given number by the government of India.

SMS format to link Aadhaar with PAN:

Send SMS to 567678 or 56161 from your registered mobile number in following format:

UIDPAN<12 aadhaar="" digit=""><10 digit="" pan="">

Example:

UIDPAN 123456789000 ABCDE1234M

Article on Hindustan Times

Guide on Business Standard Website

https://cleartax.in/s/how-to-link-aadhaar-to-pan

BankBazaar Notes

The Honourable Supreme Court in its landmark judgement has upheld Section 139AA of the Income Tax Act as constitutionally valid which required quoting of the Aadhaar number in applying for PAN as well as for filing of income tax returns. The Income Tax India official website shows this message clearly as on 14/06/2017. CBDT has extended the due date of furnishing Statement of Financial Transactions for AY 2017-18 from 31st May 2017 to 30th June 2017. https://incometaxindiaefiling.gov.in/

Method 1: Online Portal To link your Aadhaar with PAN:

* Go to the income tax e-filing website https://incometaxindiaefiling.gov.in/

* Click on the tab ‘Link Aadhaar’ on the left-hand side of the website. (See above screenshot)

* This will automatically lead you to https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

* Fill your PAN and Aadhaar number

* Then enter your name exactly as mentioned in Aadhaar and then submit it.

* Enter captcha and click on 'Link Aadhaar'.

* After verification of details from the Unique Identification Authority of India (UIDAI), the linking will be confirmed.

* You will also get email at your registered email Id.

* In case, your linking was already done earlier, it will tell you that its already linked.

Method 2: SMS Method to Link you Aadhar and PAN card

For this you have to keep ready following information:

1. Your registered phone number with Adhar card

2. Your Aadhaar Number

3. Your PAN number

You need to send an SMS in a required format to given number by the government of India.

SMS format to link Aadhaar with PAN:

Send SMS to 567678 or 56161 from your registered mobile number in following format:

UIDPAN

Example:

UIDPAN 123456789000 ABCDE1234M

Article on Hindustan Times

Guide on Business Standard Website

https://cleartax.in/s/how-to-link-aadhaar-to-pan

BankBazaar Notes

Thanks for the appreciation. Keep reading!

ReplyDeleteHave you checked out the prices for custom printing at your local printer lately? I did. cheapest color copies services

ReplyDeleteHere are some tips in finding the right people for the job and some considerations to be taken into account.

ReplyDeletehttps://edkentmedia.com/website-design-development/ is the best web agency for getting help with your web designs and projects.

ReplyDeleteWhile getting a website online as fast as possible might be convenient in the short term, it does not mean you're going to see results quickly. wordpress developer

ReplyDeleteYou completed certain reliable points there. I did a search on the subject and found nearly all persons will agree with your blog. front end development

ReplyDeleteI like this post,And I figure that they having a great time to peruse this post,they might take a decent site to make an information,thanks for sharing it to me. bitly

ReplyDeleteYou can influence blessings to up to the yearly rejection sum, as of now $14,000, to a boundless number of people, and you can twofold this sum by choosing to blessing split on a blessing tax return or by having your life partner make separate endowments to similar beneficiaries.Tax Preparation San Diego

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteAwesome blog. I enjoyed reading your articles. This is truly a great read for me. I have bookmarked it and I am looking forward to reading new articles. Keep up the good work!

ReplyDeleteMason Soiza

Very good points you wrote here..Great stuff...I think you've made some truly interesting points.Keep up the good work. freelance web designer london

ReplyDeleteThanks for Sharing ....

ReplyDeleteLink Aadhaar and PAN card

Nice Article and Thanks for sharing the useful post looking really so great. Keep doing...!

ReplyDeleteSocial Media Marketing Courses in Chennai

Social Media Marketing Training in Chennai

Pega Training in Chennai

Primavera Training in Chennai

Unix Training in Chennai

Oracle Training in Chennai

Oracle DBA Training in Chennai

Corporate Training

Social Media Marketing Courses in OMR

Social Media Marketing Courses in Tambaram