Now that it is official that you need to link your Aadhar and PAN card details, the obvious question is how to do it. This post will explain that. But before that i will like to explain some points.

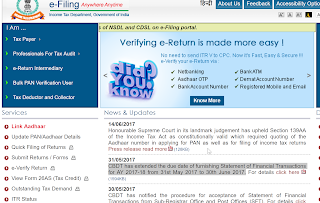

The Honourable Supreme Court in its landmark judgement has upheld Section 139AA of the Income Tax Act as constitutionally valid which required quoting of the Aadhaar number in applying for PAN as well as for filing of income tax returns. The Income Tax India official website shows this message clearly as on 14/06/2017. CBDT has extended the due date of furnishing Statement of Financial Transactions for AY 2017-18 from 31st May 2017 to 30th June 2017. https://incometaxindiaefiling.gov.in/

Method 1: Online Portal To link your Aadhaar with PAN:

* Go to the income tax e-filing website https://incometaxindiaefiling.gov.in/

* Click on the tab ‘Link Aadhaar’ on the left-hand side of the website. (See above screenshot)

* This will automatically lead you to https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

* Fill your PAN and Aadhaar number

* Then enter your name exactly as mentioned in Aadhaar and then submit it.

* Enter captcha and click on 'Link Aadhaar'.

* After verification of details from the Unique Identification Authority of India (UIDAI), the linking will be confirmed.

* You will also get email at your registered email Id.

* In case, your linking was already done earlier, it will tell you that its already linked.

Method 2: SMS Method to Link you Aadhar and PAN card

For this you have to keep ready following information:

1. Your registered phone number with Adhar card

2. Your Aadhaar Number

3. Your PAN number

You need to send an SMS in a required format to given number by the government of India.

SMS format to link Aadhaar with PAN:

Send SMS to 567678 or 56161 from your registered mobile number in following format:

UIDPAN<12 aadhaar="" digit=""><10 digit="" pan="">

Example:

UIDPAN 123456789000 ABCDE1234M

Article on Hindustan Times

Guide on Business Standard Website

https://cleartax.in/s/how-to-link-aadhaar-to-pan

BankBazaar Notes

The Honourable Supreme Court in its landmark judgement has upheld Section 139AA of the Income Tax Act as constitutionally valid which required quoting of the Aadhaar number in applying for PAN as well as for filing of income tax returns. The Income Tax India official website shows this message clearly as on 14/06/2017. CBDT has extended the due date of furnishing Statement of Financial Transactions for AY 2017-18 from 31st May 2017 to 30th June 2017. https://incometaxindiaefiling.gov.in/

Method 1: Online Portal To link your Aadhaar with PAN:

* Go to the income tax e-filing website https://incometaxindiaefiling.gov.in/

* Click on the tab ‘Link Aadhaar’ on the left-hand side of the website. (See above screenshot)

* This will automatically lead you to https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

* Fill your PAN and Aadhaar number

* Then enter your name exactly as mentioned in Aadhaar and then submit it.

* Enter captcha and click on 'Link Aadhaar'.

* After verification of details from the Unique Identification Authority of India (UIDAI), the linking will be confirmed.

* You will also get email at your registered email Id.

* In case, your linking was already done earlier, it will tell you that its already linked.

Method 2: SMS Method to Link you Aadhar and PAN card

For this you have to keep ready following information:

1. Your registered phone number with Adhar card

2. Your Aadhaar Number

3. Your PAN number

You need to send an SMS in a required format to given number by the government of India.

SMS format to link Aadhaar with PAN:

Send SMS to 567678 or 56161 from your registered mobile number in following format:

UIDPAN

Example:

UIDPAN 123456789000 ABCDE1234M

Article on Hindustan Times

Guide on Business Standard Website

https://cleartax.in/s/how-to-link-aadhaar-to-pan

BankBazaar Notes